Diving into the world of digital assets can feel like navigating a maze. However, with a bit of guidance, even newcomers can decode the complexity of Bitcoin. Firstly, let's clarify some light on read more what Bitcoin actually is: a peer-to-peer digital currency that uses cryptography for security. Unlike traditional currencies, Bitcoin isn't controlled by any government or financial institution. Instead, transactions are logged on a public ledger called the blockchain, which is always updated and transparent to everyone.

- Transfers are made directly between users without intermediaries like banks, reducing fees and increasing transaction speeds.

- Nodes play a crucial role in securing the network by solving complex mathematical problems to validate transactions and append them to the blockchain.

- BTC's limited supply of 21 million coins contributes to its scarcity, making it a potentially attractive investment for some.

However, Bitcoin is also known for its uncertainty. Its value can change dramatically in short periods, presenting it as a risky investment. Consequently, it's important to learn thoroughly before making any investments in Bitcoin or any other copyright.

Conquering the Art of copyright Trading: Strategies for Success

Diving headfirst into the turbulent world of copyright trading can be both rewarding. However, navigating its nuances requires a calculated approach. Successful traders embrace a blend of technical analysis, market sentiment, and risk management techniques to thrive in this dynamic landscape.

- Harnessing charting tools to identify patterns and trends can provide valuable indications into potential price movements.

- Quantitative analysis of blockchain technology, project development, and market adoption rates can help gauge the validity of different cryptocurrencies.

- Allocating your portfolio across various assets can minimize overall risk and create a more stable investment strategy.

Always educating yourself about market trends, regulatory updates, and technological advancements is essential for staying ahead of the curve in this rapidly evolving industry. Remember, copyright trading is a marathon, not a sprint. Discipline are key virtues to cultivate as you conquer the art of copyright trading.

Understanding copyright: A Beginner's Guide to Blockchain

The world of copyright can seem like a complicated labyrinth, filled with technical jargon and fast-paced trends. But fear not! This article will serve as your map through the exciting realm of copyright, demystifying the blockchain technology that underpins it all. We'll examine the fundamentals of blockchain, shed light on different types of copyright, and discuss the potential impact this revolutionary platform has on our world.

First things first, let's unpack what blockchain is. Imagine a virtual ledger, distributed across a network of computers, that records every transaction in a secure and transparent manner. This unalterable record ensures transparency in the system, making it ideal for copyright transactions.

- Moreover, we'll analyze popular cryptocurrencies like Bitcoin and Ethereum, understanding their unique features and purposes.

- In conclusion, we'll touch upon the future of copyright, its potential to revolutionize various industries, and the challenges that lie ahead.

The Future of Finance: Exploring the Potential of copyright

The financial landscape is evolving at an unprecedented rate, and copyright stands as a revolutionary force shaping this evolution. As blockchain technology matures and integration grows, the potential of cryptocurrencies to modernize traditional financial systems becomes increasingly evident. From decentralized finance (DeFi) platforms to secure and transparent cross-border transactions, copyright offers a novel set of solutions that have the power to democratize access to financial services globally.

- One of the most enticing aspects of copyright is its potential to provide financialliteracy to unbanked populations worldwide. By reducing the need for intermediaries, cryptocurrencies can facilitate access to basic financial tools and services, even in regions with fragile infrastructure.

- Furthermore, the security inherent in blockchain technology can help combat financial crime and malpractice. By creating a permanent and verifiable record of all transactions, cryptocurrencies can provide a robust audit trail that enhances accountability and strengthens trust within the financial system.

While the future of finance remains fluid, one thing is clear: copyright is a force to be reckoned with. Its potential to transform traditional financial systems is undeniable, and its impact will continue to be felt for years to come.

Journey From Zero to Hero: Your Step-by-Step Guide to Learning copyright

Ready to crack the world of cryptocurrencies? It might seem daunting at first, but with a solid approach, you can become a copyright pro in no time. This detailed guide will walk you through every step, from the fundamentals of blockchain to sophisticated trading strategies.

- Start with understanding what blockchain is and how it works.

- Explore the different types of cryptocurrencies available.

- Master about wallets, exchanges, and protection.

- Jump into trading with a small amount of capital.

- Keep updated on the latest copyright news and trends.

Remember, learning copyright is a ongoing process. Maintain patient, do your research, and never stop exploring.

copyright vs. Alternative Coins: A Comparative Analysis of Virtual Assets

The ecosystem of digital assets is a dynamic landscape, with Bitcoin standing as the leading player. Nevertheless, a vast array of alternative cryptocurrencies, collectively known as alternate digital assets, have emerged, each with its own distinctive features.

Comparing the original copyright to alternative cryptocurrencies reveals key variations in their applications, architecture, and size. Despite this, both classes of copyright share the fundamental goals of decentralization.

Alisan Porter Then & Now!

Alisan Porter Then & Now! Bug Hall Then & Now!

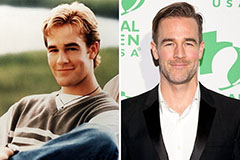

Bug Hall Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Tina Louise Then & Now!

Tina Louise Then & Now! Morgan Fairchild Then & Now!

Morgan Fairchild Then & Now!